Summary

- iBio (IBIO) is a Texas-based company whose stock is up 496% year to date on investor optimism about its COVID-19 vaccine efforts.

- IBIO claims to have been involved in several vaccines for such high profile illnesses as H1N1 and Ebola, but the company never commercialized any of its vaccines or therapeutics.

- Despite this, IBIO's founder and president have collectively earned compensation in excess of 100% of IBIO's revenues since 2008.

- We do not believe that IBIO has the resources, track record, or management leadership to execute on its purported strategy, and assign a price target of $0.43 a share.

Portfolio manager summary

- IBIO is a Texas-based company whose stock is up 496% year to date on investor optimism about its COVID-19 vaccine efforts

- We believe that IBIO is vaccine vaporware, with a history of having inserted itself into the discourse of several diseases-du-jour over the last decade including H1N1, Ebola, and now COVID

- IBIO has never actually commercialized any of its vaccine or therapeutics efforts, having eliminated pipeline disclosure in FY17

- In fact, IBIO settled a shareholder suit alleging that it lied about its Ebola claims, and we believe IBIO’s COVID effort is just a replay of the 2014 Ebola episode

- Despite this, the Roberts (Kay and Erwin), have reaped compensation in excess of 100% of IBIO’s revenues since 2008

- During Kay's tenure on the INBP board, the stock experienced a 79% collapse

- Robert Erwin, on the other hand, was CEO and Chairman of LSBC, a plant-based biotech that went bankrupt in 2006

- Between the company’s track record and management history, we believe this is a clear “fool me once, shame on you; fool me twice, shame on me” situation that investors shouldn’t get caught in. We believe that IBIO’s business is worth no more than the cash on its balance sheet adjusted for the next twelve months of cash burn, or just $0.43 per share, down 71% from the 12/7 close

All hat and no cattle

If you ever hear the saying “all hat and no cattle”, the message is simple: wearing a cowboy hat doesn’t make you a cowboy. All talk, no substance – rarely has a metaphor fit our view of a company the way it fits IBIO.

iBio is a Texas-based company that purports to develop vaccines and other therapies using its plant-based system known as FastPharming. As a fresh example of what investors are dealing with, on December 2nd, it announced a Statement of Work with Belgium-based ATB Therapeutics, which sent IBIO’s stock up ~10%, adding about $30MM to the company’s market cap.

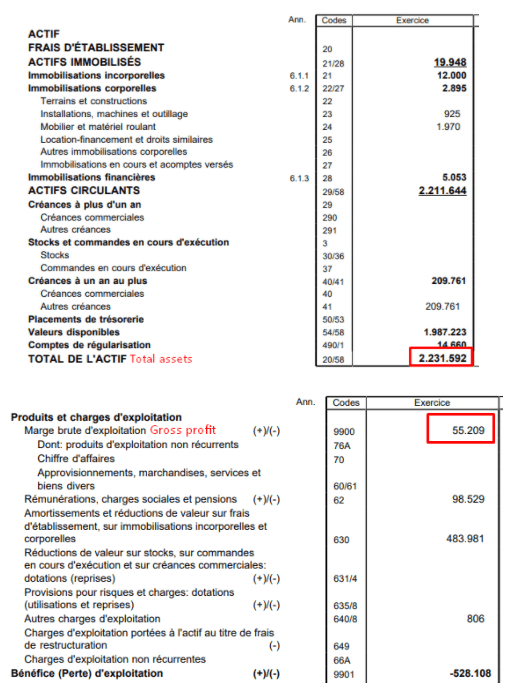

What investors miss here is that ATB Therapeutics earned only EUR 55,209 in gross profits in 2019 and had just EUR 2.2MM in assets on its balance sheet:

Source: ATB financials

We believe that investors are overly optimistic about this announcement, especially given the size of the partner – we do not believe this will be a material revenue generator for IBIO moving forward. After researching IBIO, we view this as typical of the company’s modus operandi, and think it is yet another red flag in a series of many.

In light of Moderna and Pfizer’s stunning recent announcements that their COVID vaccine candidates prevented over 90% of infections, we thought it would be important to give investors a look into purported COVID player IBIO’s business model, history, and management.

Before kicking off this report, here is a little perspective – a perspective that should give the reader an idea of the level of investment required to be competitive in the COVID vaccine race. Pfizer spent $2B to get its vaccine to this stage, and it had $1.5B in cash on its balance sheet at the end of September. Pfizer has approximately 88,200 employees.