Summary

- GS is transforming through a digital-led strategy.

- The "new" GS businesses include transaction banking, wealth management, and a consumer bank.

- GS is blurring the line between a bank and a technology company.

- Execution is well on track, but Mr. Market has not yet rewarded it with higher valuation.

- I am especially excited by the disruption potential in the transaction banking space.

Goldman Sachs (NYSE:GS), in some ways, wants to become more like JPMorgan (NYSE:JPM) and less so its old "proprietary trading" self. The firm is now pivoting to a whole raft of new businesses including consumer banking, transaction banking, and asset management. The common denominator across these businesses is their capital-light nature and the employment of digital-led strategy.

If GS is able to execute (and signs are encouraging) the incumbents such as JPM, Citigroup (NYSE:C) and Bank of America (NYSE:BAC) should be worried.

I intend to build a position in GS and buy on any dips or dislocations.

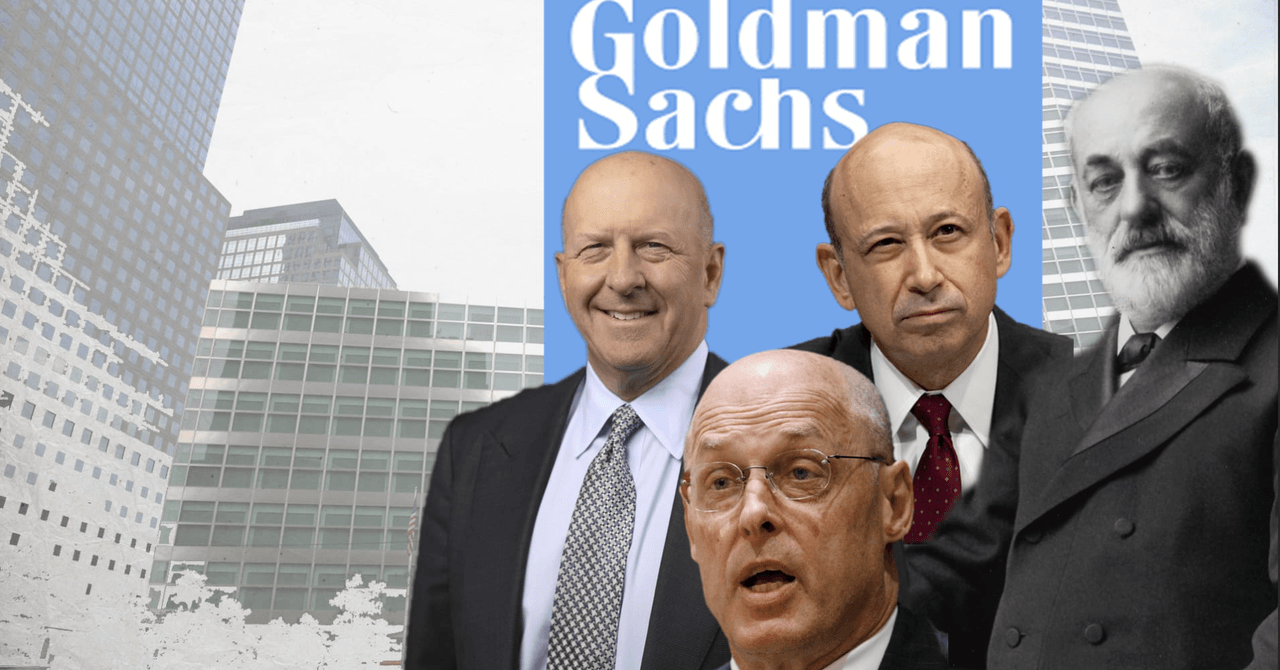

(Source)

The Thesis

GS valuation at ~1.0x tangible book is undemanding and reflects its current business model. The pivot to capital-light businesses is absolutely the right strategic choice and represents a meaningful upside if GS is able to execute.

Given the stock valuation as of today, it is a free call option.

I also believe that GS has a high probability to succeed in the transformation. GS has the resources, people, and technology to execute well, and results to date are already very encouraging. There are also significant synergies with its current business model including balance sheet, funding, and cross-selling.

The most exciting new business is the inroads made in the transaction banking space. GS has built a whole new business in 18 months. There is a massive disruption potential there, and GS is uniquely positioned to penetrate this area and dislodge the incumbents, such as Citi and JPM. And GS is probably one of the only firms that can accomplish that.

GS is utilizing technology as a key enabler and is essentially operating as a FinTech as opposed to a traditional bank. The architecture is cloud-based, API-driven, and built from the client perspective.

As the narrative unfolds, the stock should materially rerate and could deliver high-teens RoTCE in the medium term.