Summary

- American Express shares have lost nearly 4% of their market value in the past week, and they now sit 12% below all-time highs.

- 2020 has been a rough year for good reasons, but the stock is more likely to rise as the company's financial performance improves in 2021.

- I would consider owning AXP now, before shares find their way to previous all-time highs and beyond.

- Looking for a helping hand in the market? Members of Storm-Resistant Growth get exclusive ideas and guidance to navigate any climate. Get started today »

In reviewing my list of worst-performing stocks of the past week, one name stood out at the very top (or bottom, if you will) of the list. American Express (AXP) shares have lost nearly 4% of their market value in the past five trading days alone, a much worse performance than that of the financial services sector in general (XLF). The stock is now further from its February 2020 highs.

Recent weakness can probably be explained by overall equities market softness, coupled with a decline in interest rates that is usually not a bullish sign for banks and consumer credit companies. Yet, I believe that investors might be too focused on short-term concerns, missing the forest for the trees.

Credit: Seeking Alpha

Little traction so far

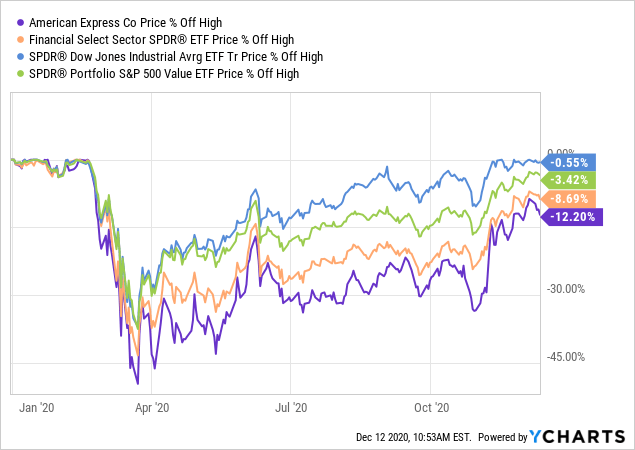

Since the start of the COVID-19 crisis, AXP declined as much as 50%, and has yet to fully recover. The chart below shows that the stock is still 12% off its 2020 peak level, while the broad market (SPY), the "old economy" Dow Jones index (DIA), value stocks (SPYV) and the financial services sector are all closer to their all-time highs.

I understand why AXP, the stock of an otherwise high-quality company, has suffered so much this year. The company's exposure to the travel and entertainment business, ravaged by the pandemic, is greater than its closest peers'. Traditionally, nearly one-third of American Express' billed business comes from T&E, one-fourth of which from small- to mid-sized customers that have been hurting the most in 2020.

Data by YCharts

Data by YChartsBut I believe that the market will continue to move past the COVID-19 impact on the economy over the next several months, as it has started to in the past few weeks. The distribution of a vaccine that leads to the gradual reopening of the global economies may not happen overnight. However, the recovery in the price of value stocks that will likely precede it should happen more quickly.

Once the near-term concerns about Amex are put to rest, what will be left are strong fundamentals and a resilient business model. On the latter, I appreciate the company's better diversified revenue mix for a credit card company, one that is not overly dependent on interest income in times of low yields. See graph below, which has been compiled using pre-COVID-19 numbers that should better reflect a "business as usual" state.