Summary

- Earnings assets grew while net charge-offs dropped in 3Q20.

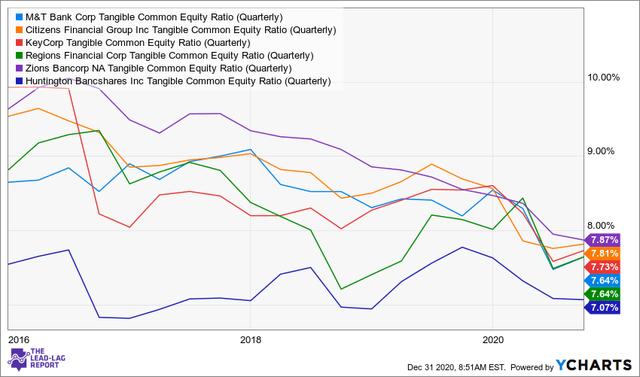

- Tangible common equity is improving from 2Q20.

- Stock price growth is below peers but trending in a strong position.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has. - John Maynard Keynes

"Leadership from energy, financials and industrials came from the belief that the economic recovery was in place and the distribution of a COVID vaccine meant it was just a matter of time before life could return to normal," as the Lead-Lag Report noted. M&T Bank Corp. has not been the leader pulling the financial sector higher, but it has a strong balance sheet, a history of being a solid underwriter of commercial loans, remained profitable throughout the pandemic, and its stock position looks strong given its sector underperformance.

Third-quarter earnings released in October showed net income below year ago levels but well off the second-quarter lows. In fact, MTB has maintained a positive EPS throughout 2020. Looking at the bank's tangible common equity, which is a better measure of a bank's ability to deal with losses, the third-quarter 2020 ratio was 7.6% compared to 8.2% a year ago, but improving from 2Q 2020. Compared to its peers, MTB is in a similar position when looking at TCE.

Net interest margin declined for the third quarter to 2.95% from 3.13% in 2Q and 3.78% in 3Q19. "The narrowing of the net interest margin from the second quarter to the third quarter of 2020 resulted from lower yields on loans and investment securities and the impact of a $4.4 billion rise in average balances of short-term earning assets, which earn a significantly lower yield than loans and investment securities," as pointed out in MTB's third-quarter earnings release. MTB's earning assets have been growing each quarter, but the decline in net interest margin resulted largely from lower yields on loans and deposits held at the Federal Reserve Bank of New York. Importantly, earning assets grew 17.5% from 3Q19 to 3Q20, so it is setting itself up for future growth.

Assets taken in foreclosure of defaulted loans dropped dramatically from 3Q19 to the current quarter, from $80 million to $50 million. This shows the strength in MTB's underwriting procedures. MTB has had to increase its provision for credit losses to $150 million from year ago levels, but this is significantly below the level at the height of the pandemic of $325 million. Another positive sign for M&T is the reduction in net charge-offs. Net charge-offs dropped to .12% in the three months ended September 30, 2020, compared to .29% in the second quarter of 2020 and .16% in 3Q19.

The recent stress test released on December 18th by the Federal Reserve showed M&T Bank with a projected CET1 ratio of 5%, which is above the required 4.5% but well below its peers. This has been one of the drags on the stock performance, but opens the opportunity to add an undervalued regional bank to your portfolio.