Summary

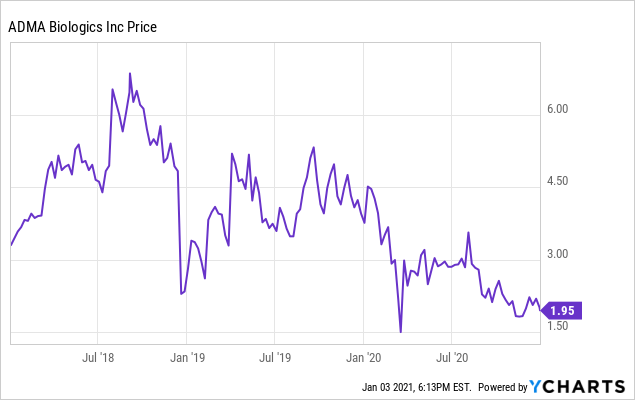

- ADMA has been overly chastised by the market, and its business is performing very well.

- At its current trading level, ADMA is trading at just about its enterprise value when considering the value of its portfolio of plasma collection centers, which will soon be 16.

- Strong insider buying, coupled with the recent adoption of a poison pill, leads me to believe that insiders agree with my assessment that ADMA is currently being undervalued.

- This idea was discussed in more depth with members of my private investing community, Invest With A Stacked Deck. Get started today »

ADMA Biologics, Inc. (NASDAQ:ADMA) is an end-to-end commercial biopharmaceutical company dedicated to manufacturing, marketing, and developing specialty plasma-derived biologics for the treatment of immunodeficient patients at risk for infection and others at risk for certain infectious diseases. I have been watching ADMA on the sidelines for several months but recently decided to buy up shares amid this perfect storm of events that has led to a tremendous sell-off and buying opportunity.

Background

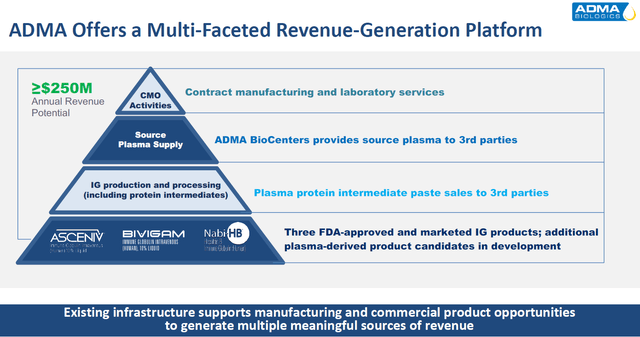

ADMA's management has set a lofty goal of generating an annual revenue of more than $250 million in the next 3-5 years. As shown in the pyramid below, ADMA has four different sources of revenue.

Source: ADMA Corporate Presentation

FDA Approved Products

The first revenue driver is its three FDA-approved products, all of which are currently marketed and commercially available: (1) BIVIGAM (Immune Globulin Intravenous, Human), an Intravenous Immune Globulin (“IVIG”) product indicated for the treatment of Primary Humoral Immunodeficiency (“PI”), also known as Primary Immunodeficiency Disease, (2) ASCENIV (Immune Globulin Intravenous, Human – slra 10% Liquid), an IVIG product indicated for the treatment of PI and (3) Nabi-HB (Hepatitis B Immune Globulin, Human), which is indicated for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis.