Summary

- Quest Diagnostics has effectively captured 24% of a $28Bn market, while earning the loyalty of 11Mn customers digitally by providing low cost, high quality services at one-eighth the cost.

- The $2.4Bn COVID-19 revenue boost in 2020 and 2021 is being underappreciated by the Street (4.5% 6-month return).

- My price target of $162 represents a 36% upside.

Quest Diagnostics (DGX) is the single largest pure-play publicly listed diagnostics company. Its disciplined growth strategy and persistent effects of COVID-19 testing have not been completely appreciated by sell-side analysts. My 100% weighted DCF model valuation yields a price target of $162 representing a 36% upside.

The Largest Diagnostics Company

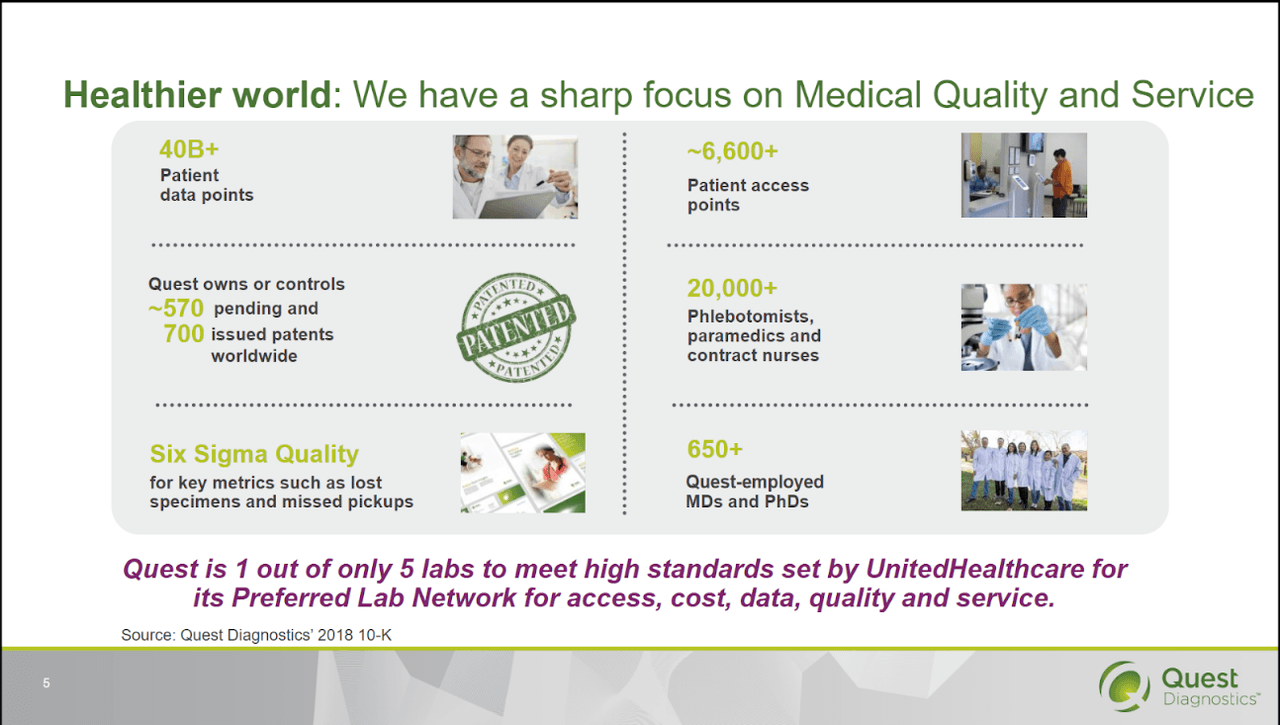

Quest Diagnostics is one of the largest diagnostics corporations in the US. The company was founded in 1967. In addition to testing (96% of revenues), it offers risk management and healthcare IT solutions (4% of revenues). Quest derives its insights from the world’s largest database of clinical lab results and serves approximately 1/3 of the adult population and half of the physicians and hospitals in the US annually. Currently, it is also involved in COVID-19 testing operations.

Quest Diagnostics has effectively captured 24% of a $28Bn market, while earning the loyalty of 11Mn customers digitally by providing low cost, high quality services that are one-eighth the cost of hospital labs.

- Diagnostic Information Services (96% of revenue): Includes routine clinical testing services (54%), gene-based and advanced diagnostics (34%) and anatomic pathology services (8%). I expect a $2.4Bn+ COVID-19 revenue windfall for 2020 and 2021.

- Diagnostics Solutions (4% of revenues): Comprises of risk assessment services, healthcare information technology (including award winning Quanum products) and Q2 Central Laboratory Solutions [JV with IQVIA Holdings (IQV)].

Image Source: DGX Investor Relations

DGX capitalizes on key industry trends

1. Consumerization: Consumers are taking increased interest in and responsibility for their healthcare, and Quest is perfectly positioned to take advantage of this through their MyQuest App which drives customer loyalty and sticky revenues, along with their partnerships with Walmart, Safeway, and CVS. The industry is making a gradual transition to consumerization, COVID-19 has only exacerbated it.

2. Price Transparency: DGX is the lowest-cost provider in the industry for insurers and customers alike. The recent UnitedHealthcare deal with Quest is a vote of confidence towards Quest’s ability to provide low cost, high value services. Again, Quest is positioned to take advantage of this trend by standing out through its economies of scale and MyQuest App, providing transparency for customers and insurers alike.