Summary

- Georgia's Senate runoffs could be consequential to the markets.

- The banks are likely to trade deep in the red, in the event of a blue wave.

- The main concerns are higher taxes and banking regulation.

- This could present an opportunity to buy the dip in Citigroup.

The Georgia Senate runoff will determine which party controls the Senate.

If Democrats win both races, then it will be a defacto blue wave. The polls seem to be turning in the favor of Democrats in the last week or so and the markets have just begun to price this in in the last couple of trading sessions.

Mr. Market generally prefers gridlock in Washington. Less risk of a radical agenda prevailing, of one party or another.

If the Democrats win both races, it is hard to predict how the market will react. On the one hand, one would expect a huge stimulus including the $2,000 cheques to individuals as well as an ambitious infrastructure investment program (renewable energy anyone?). Clearly, that is positive for the markets.

On the flip side, investors will need to price in higher tax rates for corporates and individuals and incorporate these into their earning models. Clearly, higher taxes would have a much more consequential impact on corporate America compared with a one-off stimulus.

Whilst it is hard to predict, my sense is that a Democrats clean sweep will trigger a sell-off in the markets (at least initially).

And I expect the large banks to be sold-off heavily. The key reasons being higher taxes and the specter of increased regulation.

Citigroup's (C) has a high beta to the general market and thus may be a laggard.

In such a scenario, I would look to buy the dip in Citi. My "buy zone" will be anywhere in the low 50s (if it hits that price).

My thesis is that a blue wave, in the medium and long term, has not really materially changed the calculus for Citigroup shares.

Tax reform

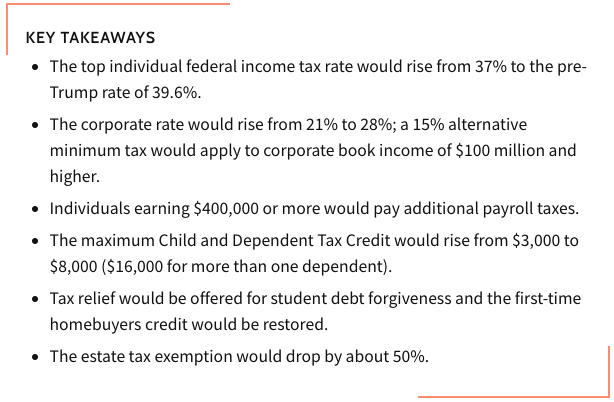

President-elect Biden tax reforms key takeaways are summarised below:

The key impact on Citi is the proposed corporate tax hike from 21 to 28 percent. There are a number of unique considerations for Citi given its tax profile. A large proportion of Citi's earnings is derived from offshore jurisdictions, as such, it is not clear whether Biden's plan would retain the current territorial tax system (i.e. no additional U.S. applicable on taxed foreign earnings) or alternatively, as was prior to Trump's tax reform, require U.S. companies to pay tax on their global income.