Summary

- Margin calls have been avoided and the dividend has been maintained through 2020.

- Loan performance is strong with 99% of interest collected during the third quarter.

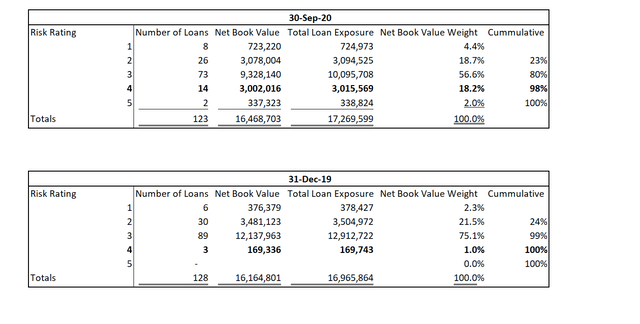

- At the end of the third quarter about 20% of the loan book had risk ratings of 4 or 5 compared to 1% at the beginning of the year.

- BXMT has plenty of firepower for new underwriting.

- Current price is attractive given the 9% yield plus slight undervaluation.

Mortgage REITs During 2020

Mortgage REITs had a difficult 2020. Thirty-two of forty-two mortgage REITs reduced or eliminated their dividends, a whopping 76%. Blackstone Mortgage Trust (BXMT) was not one of them. The chaos was highlighted at the very bottom of the crash in March by two levered ETN's going bust, MRRL and MORL. Both have been delisted.

Margin Calls and Dividend Payments

Blackstone Mortgage Trust has performed relatively well by designing a better mousetrap. The firm avoided any margin calls during calendar year 2020. Margin call provisions under BXMT's credit facilities do not permit valuation adjustments based on capital market events, and are limited to collateral-specific credit marks. This nugget informed our judgement and "very bullish" call in late March when we published Significantly Undervalued Blackstone Mortgage Trust Could Establish Itself As The Premier mREIT. Blackstone Mortgage Trust was thrown out with the bath water when the levered ETN's blew up. The key difference being, BXMT did not carry the same risk the other mortgage REITs carried.

Blackstone Mortgage Trust has maintained the dividend and as recently as 12/15/20 declared the usual quarterly dividend of $0.62 per-share. This is a significant achievement in light of the pandemic. The dividend is a significant priority to BXMT, after all it is a yield vehicle.

Loan Performance

Loan performance has been strong considering the pandemic. During Q3 99% of interest was collected and there wasn't any new credit migration to higher risk buckets. However, the portfolio did have a significant amount of credit migration through the first two quarters. Blackstone Mortgage Trust has an internal risk rating scale of 1-5, one is the lowest risk and five is the highest risk. At the beginning of the year only 1% of loans were in buckets four or five. At the end of Q3 20% of loans were in buckets four or five, 18% and 2%, respectively:

(Source: Author compilation from BXMT 10-Q)

(Source: Author compilation from BXMT 10-Q)

The biggest change has been loans moving from bucket three to bucket four. These are mostly hospitality asset loans.