Traditional electric vehicle manufacturing stocks face a threat from new entrants led by Tesla (NASDAQ:TSLA) that include developers of a one-seat, three-wheel commuter car, delivery trucks and light duty trucks for commercial fleets.

The traditional electric vehicle manufacturing stocks for investors to consider now have fledgling rivals seeking to serve market niches by offering unique capabilities that established automobile companies may not target as keenly. However, the competitive road ahead for traditional electric vehicle manufacturing stocks and their entrepreneurial electric vehicle (EV) rivals will require attaining scale, meeting price points customers will pay, availability of interstate charging stations and obtaining cost-effective and powerful battery technology to substitute for fuel stations.

Electrameccanica Vehicles Corp. (NASDAQ:SOLO), of Vancouver, British Columbia, plans to offer a one-seater, three-wheel EV that will be priced at $18,500. It is meant to be a commuter vehicle, since 80 mph will be its top speed and it will have a limited travel range of 100 miles per charge.

Traditional Electric Vehicle Manufacturing Stocks Fueled by Electrifying $142 Billion Investment

Traditional electric vehicle manufacturers are pumping tens of billions of dollars into EV development individually. Detroit’s General Motors (NYSE:GM) announced plans to spend $27 billion on all-electric and autonomous vehicles, as well end production of internal-combustion engine (ICE) vehicles and only offer zero-emission models by 2035. GM also plans to offer 30 new EVs globally by 2025. General Motors suspended its dividend in 2020 amid the raging COVID-19 crisis but is considering restoring it in the months ahead.

Ford Motor Co. (NYSE:F), of nearby Dearborn, Michigan, is committing more than $22 billion into its electric vehicle program through 2025, with an additional $7 billion going to driverless-vehicle tchnology, the company announced Feb. 4. The global pandemic caused Ford to suspend its dividend but it is among the traditional auto makers that typically resume the payout as the cyclical industry recovers from weakness.

European automobile manufacturing powerhouse Volkswagen Group (OTCMKTS:VWAGY) disclosed plan in November 2020 to raise spending on technologies for electric and self-driving cars by boosting its financial commitment to $86 billion, or 50% of the company’s budget through 2025, while boosting production of EVs in its domestic market of Germany. It marks a $15 billion jump from the $71 billion, or 40% of its budget, it announced the prior year. Volkswagen currently offers investors a 3.15% dividend yield.

Perry Picks SOLO to Survive Among Traditional Electric Vehicle Manufacturing Stocks

Bryan Perry, who recommended SOLO in his Hi-Tech Trader service on Jan. 15, watched the stock rise 5.81% through the close of trading on Feb. 2. Based on pure EV sector momentum, he has a target on the stock’s share price of $12, projecting a 58.52% gain from his buy price.

To read the rest of the column, please click here.

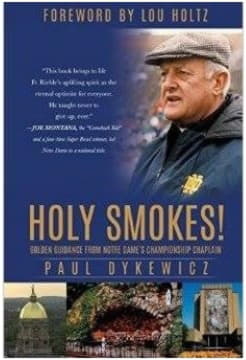

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Paul also is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The book is great as a gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others.