Today, financial technology startup Carefull launches a new platform to help family members and caregivers organize and protect daily financial matters for aging loved ones. Carefull looks to bring simplicity and intelligence to the emerging space of financial caregiving, and has raised $3.2M in seed funding led by NextView Ventures and Bessemer Venture Partners.

Today, over 45 million U.S. adults are responsible for managing an aging parent or loved one's finances. According to a study from Merrill Lynch, 41% are called to this work due to a sudden event, like a scam, missed bill payment, or, in many cases, the diagnosis of a memory disorder, such as Alzheimer's disease. Financial caregiving can be a decades-long journey, and includes setting budgets, paying bills, catching errors and fraud, and coordinating family support, usually without any formal training and often from far away.

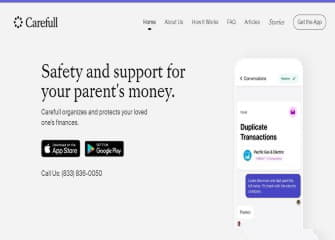

Carefull addresses this problem by integrating transaction and financial behavior monitoring, family financial communication, and educational content into a simple mobile platform. Using deep financial insights and analysis as the baseline, Carefull allows family members and other caregivers to build a secure "circle of care" around an aging loved one, while preserving their dignity and independence.

The Carefull app sits on a world-class AI platform that analyzes and detects patterns in financial behaviors of the aging, bringing much-needed innovation to a poorly understood segment of the population, with the potential to benefit the entire ecosystem: families, banks, advisors, and insurance providers.

The Carefull platform could even help loved ones predict cognitive decline faster, as research released by John's Hopkins in November of 2020 revealed that older adults show symptoms of dementia via financial mistakes up to 6 years before a medical diagnosis, as revealed in missed bills and reduced credit scores.

According to Max Goldman, Carefull's CEO: "The intersection of family and money inevitably leads to a series of stressful challenges. And, at some point, someone in every family will take on the role of financial caregiver. Carefull exists because there had to be an easier, smarter, more empathetic way to support and protect those who supported and protected us."

"Senior caregiving is typically treated as a healthcare crisis or sometimes a coordination issue," says Todd Rovak, Co-Founder at Carefull, "but it's also the largest and most unaddressed challenge in consumer financial services — no simple tools, intelligence, or protections."

Carefull is free to try for both Apple and Android devices and then $9.99 per month when paid annually or $12.99 per month when paid monthly. You can learn more about Carefull at GetCarefull.com

About Carefull

Carefull is the first digital platform built for the 45 million U.S. adults managing and monitoring the daily finances of a loved one. Founded in 2019, Carefull's technology integrates caregiving-specific financial monitoring, communication, and how-to content, replacing the ad hoc paper pile, spreadsheets, bill stack and hold music that today greets adults caring for someone else's money. Carefull believes that creating safer, smarter tools for financial caregiving isn't only about money. It's about relentlessly simplifying the awkward tangle that happens when money and family come together.

The company is backed by notable investors including Charles Birnbaum at Bessemer Venture Partners and Rob Go at NextView Ventures. Other investors include Adam Nash, former CEO of Wealthfront and Rob Bernshteyn, CEO of Coupa as well as Max Simkoff (States Title), Lane Shackleton (Coda), Andres Blank (Fetcher), Phil Farhi (Pinterest), Steve Schlafman and K50 Ventures.