Summary

- W.P. Carey continued to post stellar rent collection figures, with 99% of rent checks accounted for during the fourth quarter.

- Management guides for roughly $1 billion to $1.5 billion of capital investments across its portfolio in 2021.

- We’re always happy to buy the highest-quality blue chips when they’re trading at fair value or better.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Get started today »

This article was coproduced with Nicholas Ward.

W.P. Carey (WPC) certainly isn’t one of the most exciting equities we cover at iREIT on Alpha. Then again, the stock market isn’t meant to be a form of entertainment.

It’s supposed to be a vehicle that allows shareholders to compound their wealth and reach financial freedom. By that second goal, we usually mean:

- The passive income (i.e., dividends) our holdings generate for us

- Their reliable and predictable nature

- The growth they experience over time

For most people, financial freedom comes when their passive income exceeds their lifestyle’s expenses. That way, there’s no longer a need to go to work every day and generate an active income.

It’s like that famous Warren Buffett quote – “If you don’t find a way to make money while you sleep, you will work until you die.”

If you love your job and plan to work as long as you’re physically/mentally capable, that’s great. But many people have passions that lie outside their professions. That’s why we focus so heavily on generating safe, reliable, passive income.

And that’s exactly where W.P. Carey shines.

While its growth may be boring or even displeasing to some, the cash flows it generates give us peace of mind, which is exactly what we’re looking for in the markets.

(Source: WPC Website)

(Source: WPC Website)

The Dividend

Naturally then, let’s start off by talking about W.P. Carey’s illustrious dividend. The stock currently trades at $70.39, which gives investors a 5.94% dividend yield.

Nice, right?

WPC is known for its high yield well above its other blue-chip, triple-net peers:

- National Retail Properties (NNN), which yields 4.92%

- Realty Income (O), which yields 4.51%

- STORE Capital (STOR), which yields 4.37%

- Agree Realty (ADC), which yields 3.82%

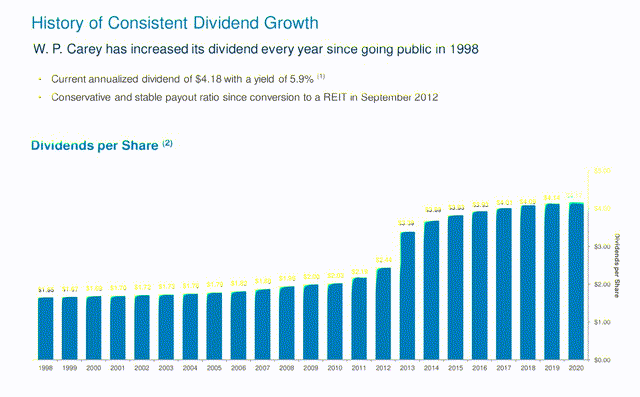

Admittedly, WPC has lagged in terms of dividend growth in recent years. Its longer-term track record is phenomenal, as shown below.

(Source: WPC Q4 ER Presentation, page 23)

But its three- and five-year dividend growth rates are both below the typical 2% inflation rate to just 1.2% and 1.7%, respectively.