Higher levels of liquidity, tighter credit spreads and a modest loosening of underwriting standards contributed to a sharp improvement in commercial real estate lending momentum in Q4 2020, according to the latest research from CBRE.

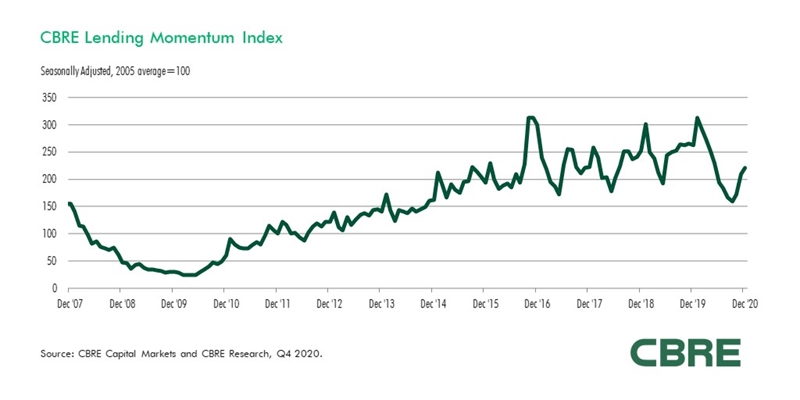

The CBRE Lending Momentum Index, which tracks the pace of commercial loan closings in the U.S., reached a value of 221 in December, up by 38.2% from September. As of December 2020, however, the index was still down 16% from a year ago.

"Capital markets helped bolster commercial mortgage lending at year-end as equity prices rose and corporate loan spreads tightened. With lending markets anticipating the effects of additional government economic stimulus on growth and inflation, Q4 2020 saw increased participation by alternative lenders and life companies compared with Q3. Certain deals remained challenging to underwrite, especially for retail, hotel and transitional assets,” said Brian Stoffers, Global President of Debt & Structured Finance for Capital Markets at CBRE.

CBRE’s lender survey indicates that the composition of the non-government agency commercial real estate lending market in Q4 2020 resembled the more balanced conditions that existed pre-pandemic. There was strong participation from alternative lenders for bridge loans and life companies for stabilized low-leverage loans in Q4 2020. The government agencies also had stellar production, which provided high levels of liquidity to the multifamily market.

Alternative lenders, which include debt funds, finance companies and mortgage REITS, captured the highest share (36%) of non-agency loan closing volume in Q4 2020. Alternative lenders were the leading source of bridge loans to the multifamily, retail and office sectors.

After a weak spring, life company lending gathered momentum in late 2020. Life company market share increased to almost 30% in Q4 2020, reflecting improved market participation and lenders' need to deploy mortgage investment allocations by year-end. The Q4 2020 originations were largely low-leverage permanent loans backed by industrial, office, retail, and multifamily properties. Life company LTVs averaged 53% in Q4 2020.

Regional banks continued to play an important role in commercial mortgage markets at year-end, accounting for 23.7% of originations in Q4 2020, down only slightly from year earlier levels. In addition to permanent loans, banks provided construction financing, primarily for multifamily and industrial projects.

CMBS lenders captured just over 10% of originations in Q4 2020. Industrywide CMBS issuance was $16.55 billion in Q4 2020, bringing the full-year total to $59.25 billion. Due to the disruption of capital markets in the spring, issuance was down 39% from 2019's $97.77 billion.

With capital availability improving in Q4 2020, lenders granted generally higher loan proceeds and underwriting standards were slightly less restrictive. Average loan-to-value ratios (LTVs) increased for permanent commercial and multifamily loans after reaching lows in Q3 2020 not seen since the Global Financial Crisis.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas is the world’s largest commercial real estate services and investment firm (based on 2019 revenue). The company has more than 100,000 employees (excluding affiliates) and serves real estate investors and occupiers through more than 530 offices (excluding affiliates) worldwide. CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. Please visit our website at www.cbre.com.